Tangents - A Multi-Agent LLM Framework for Autonomous Trading

Abstract

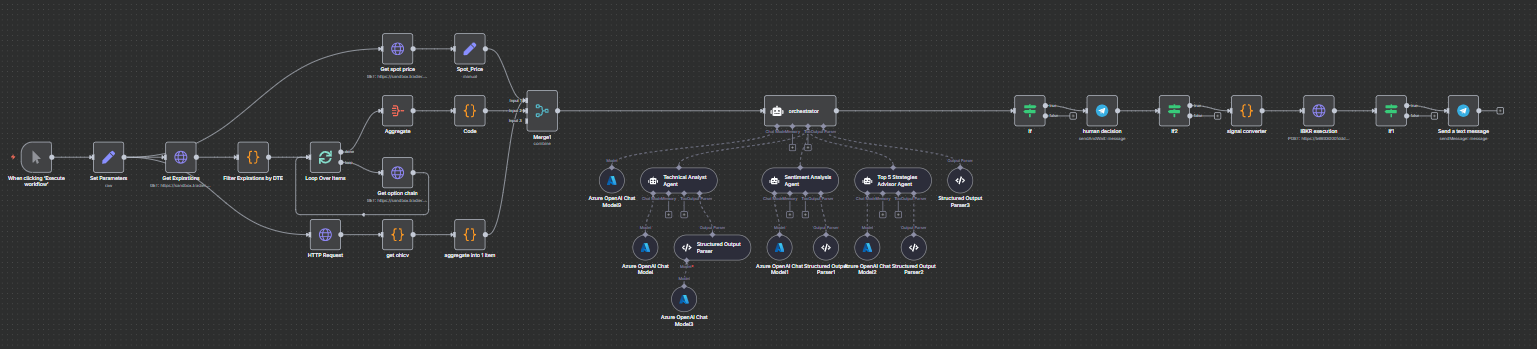

We present Tangents, a novel multi-agent framework for autonomous stock trading that emulates the operational structure of professional trading firms. Tangents orchestrates a suite of specialized agents—each powered by large language models (LLMs)—to perform distinct roles such as market analysis, research synthesis, trade execution, and risk management. Through structured communication protocols and dialectical reasoning, Tangents achieves superior trading performance, demonstrating up to 30.5% annualized returns with enhanced Sharpe ratios and minimized drawdowns compared to traditional rule-based strategies.

2. Agent Role Specialization

Tangents decomposes the trading process into discrete functional roles:

| Agent Role | Function |

|---|---|

| Fundamental Analyst | Evaluates company financials and valuation metrics |

| Sentiment Analyst | Extracts market sentiment from social media and public discourse |

| News Analyst | Interprets macroeconomic and geopolitical news for market impact |

| Technical Analyst | Applies quantitative indicators to identify price trends |

| Researcher (Bull/Bear) | Synthesizes analyst inputs through dialectical reasoning |

| Trader Agent | Executes trades based on synthesized insights and market conditions |

| Risk Manager | Assesses exposure and enforces portfolio constraints |

| Fund Manager | Finalizes and authorizes trade execution |

Each agent is instantiated with a tailored prompting strategy and toolset, enabling domain-specific reasoning and output generation.

3. Communication Protocol

Tangents employ a hybrid communication model:

- Structured Outputs: Agents produce standardized reports and diagrams for traceability.

- Natural Language Dialogue: Used selectively for debates and deliberations within Research and Risk teams.

- Global State Access: Agents query shared memory to maintain context and continuity.

This protocol ensures low information entropy and high interpretability across agent interactions.

4. Backbone LLM Strategy

Tangents utilize a dual-tier LLM architecture:

- Fast Models: For real-time data retrieval and lightweight tasks.

- Deep Models: For complex reasoning, trade synthesis, and risk evaluation.

This design minimizes computational overhead and allows deployment without GPU acceleration. The framework is model-agnostic, supporting plug-and-play integration of alternative LLMs.

5. Explainability

Unlike opaque deep learning models, Tangents provides full transparency:

- Each agent logs its rationale and tool usage.

- Decision paths are traceable via structured outputs.

- Debates and trade-offs are documented for auditability.

This interpretability is critical for real-world financial applications and regulatory compliance.

6. Conclusion and Future Work

Tangents demonstrate the viability of multi-agent LLM frameworks in financial trading. Its modular architecture, explainable outputs, and superior performance metrics position it as a promising foundation for next-generation autonomous trading systems.

Future directions include:

- Real-time deployment with live data feeds

- Expansion of agent roles (e.g., macro strategist, quant researcher)

- Integration with reinforcement learning for adaptive strategies